Saving energy and money go hand-in-hand. We can all contribute to reducing Austin’s energy demand by making simple lifestyle changes and energy-efficient home improvements. When demand decreases, we all save. Austin Energy is committed to helping our customers achieve the greatest savings possible.

Integrate high efficiency lighting into your construction projects. The best time to invest in energy efficiency is during new construction. Austin Energy offers tiered new construction lighting incentives to encourage greater energy savings for our customers.

-

Description

-

Incentive

-

Eligibility

-

How to Apply

Building owners, design professionals, contractors, or other agents are eligible to apply for Austin Energy new construction lighting rebates on behalf of their customers.

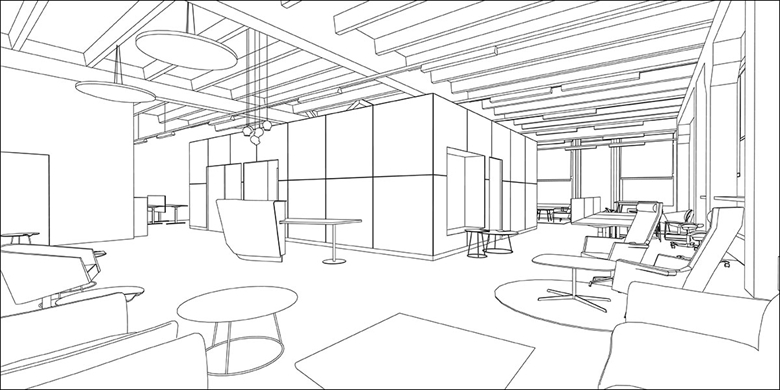

Higher savings for new construction lighting can be achieved by using a combination of higher efficacy LED lights and a better lighting design. Having an efficient lighting design helps eliminate excess fixtures, such as accent lighting (decorative fixtures), while ensuring adequate lighting levels within the space.

PACE Financing Available

Austin Energy provides various opportunities for our customers to purchase energy efficient technologies. Many of these reduce energy consumption and enhance comfort and indoor air quality for your customers. PACE is an effective financing approach. Travis and Williamson County PACE programs enable owners of non-profit, commercial, and industrial properties to obtain low-cost, long-term financing for water and energy efficiency improvements and solar generation retrofits.

Private sector lenders finance qualified improvements and property owners voluntarily agree to contractual assessments imposed on the property. PACE improvements generate positive cash flow with no out-of-pocket cost to the property owner. If the property is sold before the full amount is repaid, the repayment obligation automatically transfers to the next owner. PACE assessments complement Austin Energy incentive programs.

Incentive Rates for New Construction Lighting

Austin Energy uses incentive tiers to encourage higher efficiency new construction lighting. Incentives are calculated based on the energy saved (kW) compared to building energy code baseline. Projects that achieve higher savings are eligible for a higher $ per kW saved incentive rate.

| Incentive Tier |

% Wattage Reduction Compared Building Energy Code |

$/kW |

| All Buildings Except for Parking Garages or Warehouses | ||

| Tier 1 | Less than 20% reduction | $105 |

|

Tier 2 |

Between 20% to 40% reduction | $210 |

|

Tier 3 |

Greater than 40% reduction | $370 |

| Parking Garages or Warehouses | ||

| Tier 1 | Less than 60% reduction | $105 |

|

Tier 2 |

Greater than 60% reduction | $210 |

Prerequisites

- For retrofits and equipment replacement, applicants must submit rebate applications before installation. For new construction projects, applications must be submitted before the certificate of occupancy is issued. Rebates will not be provided retroactively.

- Rebates are only available for equipment or retrofits that:

- Operate weekdays between 3 p.m. and 6 p.m., June through September (educational facilities and houses of worship are exempt from this requirement)

- Use electricity as its primary or secondary fuel type (please refer to Texas Gas Service for rebates on natural gas equipment)

- Provide kW savings by exceeding requirements for energy efficiency listed in City of Austin Energy Code Chapter 25-12-261 or as determined by Austin Energy

- Are new, energized, and have a minimum one-year warranty (backup or redundant systems are not eligible) and

- Are installed in permanent buildings or structures

- Commercial Rebates are available for Austin Energy customers with commercial electric service.

- The building where the equipment will be installed must comply with the Energy Conservation Audit and Disclosure (ECAD) ordinance (unless exempt or located outside of Austin city limits).

- Multifamily properties applying for Commercial Rebates (for master-metered properties or work undertaken in common spaces) must meet all Multifamily program and equipment installation requirements. Properties must not be listed with the City of Austin Code Department’s Repeat Offender Program.

New Construction Lighting Requirements

- Building components required by code are not eligible for rebate.

- A lighting COMCheck is required to complete the rebate application.

Commercial Rebate Program Requirements

- Austin Energy can help customers evaluate energy efficiency opportunities for their business or organization. Please email us for help calculating potential rebates or other technical guidance.

- Applications must qualify to receive at least $25 in rebates.

- The customer or contractor applying for the rebate must:

- Submit all required application information and equipment documentation (incomplete applications are placed on hold and may be cancelled after 90 days).

- Agree to schedule pre-installation and post-installation site visits to allow Austin Energy staff to verify existing and installed equipment.

- For customers or properties applying for a rebate to upgrade or retrofit the same equipment that received a historical Austin Energy rebate within the past 10 years, the new rebate will be calculated based on the incremental energy savings. For example, suppose a customer or property received a historical lighting rebate. In that case, any new lighting equipment rebates will be calculated using the incremental energy savings between the existing and new equipment. Exemptions from this requirement due to emergency replacement of failed equipment are evaluated on a case-by-case basis.

- A 30% bonus rebate is available for eligible: 1) locally owned or franchised small-business customers; 2) small 501(c) non-profit organizations; and 3) houses of worship. Eligibility for large campuses or facilities with multiple accounts held by one customer will be determined on a case-by-case basis. Contact us to

determine if you qualify.

- Eligible small businesses must: 1) be locally owned or franchised (headquartered in the Austin metropolitan area — a W-9 may be required to verify); and 2) use Austin Energy Secondary Voltage Rate 1 (<10kW) or Rate 2 (>10kW <300kW).

- Eligible non-profits must: 1) provide an IRS determination letter or similar IRS documentation verifying their tax-exempt 501(c) status; and 2) use Austin Energy Secondary Voltage Rate 1 (<10kW) or Rate 2 (>10kW <300kW). Government entities, tax-exempt real estate trusts and housing co-ops are not eligible for this bonus.

- All houses of worship are eligible, regardless of rate.

- Rebates will not be paid unless all installed equipment and retrofits comply with the manufacturer's requirements and all local, state, and federal regulations, including building code and permitting requirements. For requirements on when electrical permits are required, refer to City of Austin Municipal Code chapter 25-12-113, section 80.19(c). For requirements on when permits are required for mechanical work, refer to City of Austin Municipal Code chapter 25-12-133, section 104.2. For more information on mechanical, electrical, and building permits contact the City of Austin Department of Development Services.

- Commercial Rebates are subject to capping based on the total project cost related to the installation of the rebated equipment or retrofits. The applicant is responsible for reporting total job cost. Austin Energy reserves the right to require a signed, itemized invoice or work order for verification.

- Standard Commercial Rebates cannot exceed 50% of total job costs.

- Rebates cannot exceed 80% of total job costs for locally owned small businesses, non-profits, and houses of worship that receive the 30% bonus.

- By default, the rebate payment is directed to the customer listed on the Austin Energy electric account. The rebate may also be directed to one of the following parties if all requirements are met.

- A parent corporation or organization of the account holder

- The building owner, who is verified using county tax records

- A tenant at the property, who must provide a letter signed by the account holder authorizing the rebate to be paid to the tenant

- A participating contractor or any other third party, who must: 1) register as a City of Austin vendor; 2) register in Austin Energy's rebate processing system; and 3) provide a letter signed by the account holder authorizing the rebate to be paid to that party

- If a participating contractor plans to submit more than one rebate application on behalf of Austin Energy customers, they are required to: 1) register as a City of Austin vendor; and 2) register in Austin Energy's rebate processing system.

- Austin Energy reserves the right to deny or adjust all rebate applications.

- Participating contractors must comply with all program requirements and conduct business in an honest, professional, and ethical manner. All participating contractors must abide by the Austin Energy Code of Conduct and Ethical Requirements (pdf).

General Instructions

- Please submit all rebate applications before installation is complete. Applications submitted after the work is complete will not be accepted.

- See below for a list of documents and information required to complete the rebate application.

- Please inquire whether your installation contractor is registered with Austin Energy and able to submit the application on your behalf.

- By default, the rebate payment is directed to the account holder, but payments to contractors and alternate payees are possible with the account holder’s approval.

- If you have any questions or need assistance with verifying eligibility or estimated rebates, email Austin Energy Commercial Rebates.

Online Application

Account holders may submit applications using the Commercial Online Rebate Application. If you are unsure of any values or fields, make a note in the comments so they can be corrected or verified later.

Required Documents and Information for Commercial Rebate Applications

- Austin Energy Commercial account number

- Contact information, if different from account information

- Pre- and post-installation photos may be required for existing and/or installed equipment

Interested in New Construction?

We can help you estimate rebates and evaluate efficient design options before construction begins.

Apply for a Rebate Online

You can apply for your rebate online. To make applying easier, have all required information on hand before you start.

Are You Waiting for a Rebate?

Use the confirmation (enrollment) and utility account numbers to check the status of your rebate application.

- Lighting retrofits require pre-installation pictures of existing equipment

- Applications must include a completed Austin Energy Lighting Calculator. Please email Austin Energy Commercial Rebates to obtain the calculator file or receive assistance.

- Manufacturer specification sheets and AHRI cut sheets for equipment to be installed

- This may be submitted via email after submitting the application.

- Invoice or quote

- This may be submitted via email after submitting the application.

- Rebate payee

- By default, rebate payments are directed to the Austin Energy electric account holder. The rebate payment may be directed to other parties with the authorization of the Austin Energy account holder.

NOTE: If your building is over 10,000 square feet, you must comply with the Energy Conservation Audit and Disclosure (ECAD) ordinance.

Non-Profit and Small Business Bonus

A 30% bonus is available for these eligible customers:

-

Texas-owned or franchised small-business customers

- Must use Austin Energy Electric Rate Tier 1 (<10kW) or 2 (<300kW) and may be required to provide a W-9 verifying the business is Texas owned or franchised.

-

Non-profit organizations

- Must use Austin Energy Electric Rate Tier 1 (<10kW) or 2 (<300kW) and may be required to provide an IRS determination letter or similar documentation verifying their tax-exempt 501(c)(3) status.

- Tax exempt real estate trusts and housing co-ops are not eligible.

-

Houses of worship

- All houses of worship are eligible, regardless of electric rate.

Contact Austin Energy for More Information

- Call 512-482-5346 or email Austin Energy Commercial Rebates if you have questions about our rebates

- Browse all Commercial rebate offerings and requirements

Additional Documents

Additional Documents

Disclaimer

Funding is limited and available on a first-come, first-served basis. Offerings, program guidelines, and rebate levels are subject to change without notice. Rebate funds are encumbered (committed to be paid) during the fiscal year in which they are to be disbursed.

The maximum combined rebate is $300,000 per customer site per fiscal year (October through September).